Accounting might not be the most interesting topic when you’re starting a business. It brings to mind complex spreadsheets and hours scavenging for receipts. But your business depends on good accounting. You started a company to make money – or at least run a sustainable enterprise – and you will never achieve this without tools like a balance sheet, tax documents, and a budget or forecast.

To many entrepreneurs, accounting can seem intimidating. You probably got started with a great idea for a product or service, not for day-to-day requirements of running a business, like accounting. To help you get over this hurdle, we met Ashley Christenson, a tax manager at Tanner LLC, a local public accounting firm, to gain some insights for getting started with accounting for your business. Below are seven things she said you must know.

The most basic place to start is simply knowing the definition of accounting. Christenson shared this definition from Investopedia: “Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities.”

More simply, accounting is recording all the financial information for your company, Christenson said. Without accounting, you won’t be able to keep track of your business, you won’t know whether it is successful or not, and you will likely have problems with taxes. You also will have a hard time getting bank loans and investors, because they often require detailed financial information.

With that, let’s dive into the seven things you must know about accounting when starting a business.

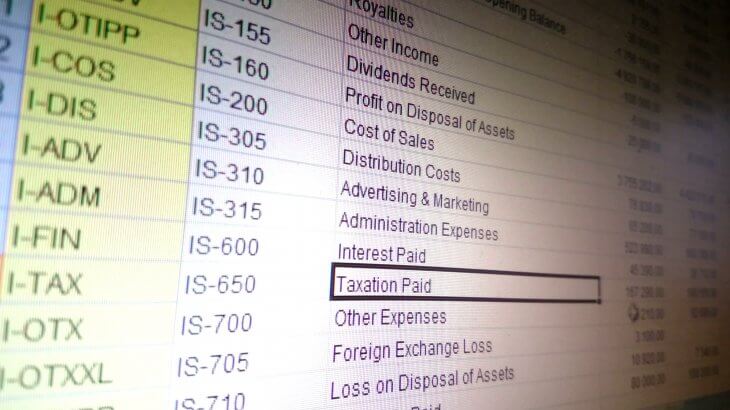

1. Track Your Income & Expenses (Income Statement)

If you started a business, you will likely want to make money, and it’s very important that you have a system for recording your income and expenses, Christenson said. The first decision you need to make is how you want to record these things. You can choose between an Excel document, a Google sheet, Quickbooks, or another tool, depending on the complexity of your business transactions. You also need to choose if you want to do this yourself, outsource the work, or if you want to hire someone else.

You will want to start keeping records immediately after starting a business. Don’t wait, because you will regret it when you eventually need these records, and you are forced to find records and information that is no longer easy to get, Christenson said. Then you can consider hiring an accountant, either to manage all your accounting needs or maybe just to look at your records periodically to see if anything looks off. “We all make mistakes, we are human,” Christenson said. Her firm has four levels of review on tax documents before they are sent to the IRS, to make sure everything has been considered and seen by multiple people.

When keeping records, make sure to store your original receipts. Yes, you will likely need those. If you get audited by the IRS, they will want to see receipts, not your Excel file. Christenson recommended that businesses keep their receipts until the statute of limitations on your tax return has expired, then it’s probably safe to toss them for tax purposes.

2. Track Your Assets, Liabilities, and Equity (Balance Sheet)

A balance sheet is a statement of your business’s assets, liabilities, and capital. You will need one. Accountants use this standard formula to create a balance sheet: Assets = Liabilities + Owner’s Equity. Assets are anything that your company owns of value, like cash, product inventory, computers, and so on, Christenson said. Liabilities are things your company owes, like a loan or credit card debt. Owner’s equity is the rights the owners have to the company’s assets, or said another way, it is basically the owner’s investment into the company and the cumulative earnings of the company.

You may not use a balance sheet much in the beginning, but it will eventually become very important as banks and investors often require them when reviewing your business. You may also find them helpful because they provide a snapshot of your business at any point in time. “It will give you a good sense for where your business is as a whole,” Christenson said.

3. Have Separate Bank/Credit Card Accounts under the Company Name

If you have a business, you will want to create separate accounts for banking, credit cards, and similar needs. Don’t use your personal credit card to buy supplies. Don’t deposit income into your personal bank account. Keep these things separate to organize your accounting and protect yourself.

Keeping separate accounts will help you if any tax or legal issues arise. They allow you to clearly define where your business ends and where your personal finances begin. If these are combined, it can be impossible to know the difference, and you might become personally responsible for company debts and other liabilities. If that is not enough reason, keeping separate accounts is often required for a bank loan.

4. Save for Taxes

Yes, you will need to pay taxes. Start planning for it. The tax laws that apply to your business depend on the nature of your company, where you are, and what you sell. You will need to do some research and probably talk to an accountant to know exactly what rules apply. Whatever they are, you will need to file taxes.

During the first few years, many startup businesses will lose money. In that case, you probably won’t need to pay any income tax, but you will still need to file an income tax return for your business. When you do start making money, you will need to start paying income taxes. This can come as a surprise if you’re not prepared for it. You want to know this well in advance so you can be ready for it. “When you start making money, put money aside for taxes,” Christenson said.

5. Think about Sales Taxes, File if Necessary

Be prepared to collect sales tax. Rules are complicated and vary by jurisdiction, depending on state, county, and city. As an entrepreneur, the most important thing is to know what rules apply to your company and plan for them as you prepare financial projections, set your sales prices, and other tasks. Your business may not be subject to sales tax in certain jurisdictions, depending on your product and location of sales.

Sales tax is likely a cost that you can pass on to your customers, so you won’t need to pay for it yourself if you are prepared, Christenson said. For example, grocery stores generally charge everyone sales tax at the cash register, then they collect all the taxes paid and remit it to the government. But if you don’t plan for this and are not charging it to your customers when you need to, you might find yourself paying these taxes yourself when a state agency comes asking for back taxes.

6. File Your Income Taxes

Income taxes are another type of tax that you should anticipate. Like other types, the rules and requirements vary. You may need to consult an accountant to determine exactly what rules are relevant to your company. One determining factor is the type of business that you have. Is it a sole proprietorship? C-corp? S-corp? LLC or partnership? Depending on the type, you will file and pay your income tax in a different way.

For example, if you are a sole proprietor, you will need to file Form 1040 Schedule C. Or if you have a multi-member LLC or partnership, you will file Form 1065, then income and expenses “flow through” to each owner in the form of a Schedule K-1 that is ultimately reported on their Form 1040, if they are an individual owner.

Depending on your business and circumstances, you might prefer one method for filing income taxes over another. You may want to consider this when deciding what type of entity to form. You will also want to consult an attorney to consider legal implications of each entity type, since tax implications aren’t the only things you should consider when choosing a business type. You will be doing yourself a favor if you think about all of these things before your company grows and becomes more complicated. “Getting a good start is super important,” Christenson said.

7. Budget & Forecast

As you start building your business, you will want to create a budget for your income and expenses and forecast how things will look in the future. Don’t get carried away when forecasting. Instead of planning 10 years out, when you hope to be a millionaire, start with next year and maybe up to five years from now. Be as realistic as you can be.

A carefully prepared budget can be extremely helpful as grow your company. Looking for a place to trim costs? Want to grow revenues? Look at your budget and start tweaking things to see what difference it makes.

In addition to helping you manage your business, a budget and forecast can help you get funding. Banks and investors will want to know the details of your business and what it will look like in the future. Like you, they will want to make sure it’s set up to succeed, and nothing can do this like a spreadsheet with an outline of all of your expenses and incomes, projected into the future.

Where to Learn More

Now that you have learned accounting basics, you may be ready to dive in deeper to learn the rules that apply to your company, what exactly investors will want to see, and what sort of taxes you will need to pay. Christenson recommended a variety of resources to help. The U.S. Small Business Administration has many helpful resources that are easy to understand and relevant for entrepreneurs. You can also go directly to the Internal Revenue Service for information. At the very least, you will want to visit these websites, click around, and see what is available for later reference.

Beyond these resources to help yourself, you will likely need professional advice at least to point you in the right direction. When you are bootstrapping, this might be a free mentoring opportunity, like those provided through the Hours with Experts program at the Lassonde Entrepreneur Institute for students at the University of Utah. As you grow, it may become more important that you consider hiring an accountant to help you at least occasionally.

The fact that you are reading this article shows that you are already heading in the right direction. Just keep asking questions, finding good resources, and getting help when you need it, and you will be able to master accounting for your business. Your success depends on it.

I like how you said that without accounting you won’t be able to track your business. I think a lot of people are trying to figure out what else they can do to keep track of their money. If you can’t do it on your own then hire an accounting service so you don’t start going downhill.

My parents and I want to start a business and we are looking for advice to know more about accounting services and be able to hire the right bookkeeper. I love that you talked about all the important finances and expenses that should be tracked and organized. We´ll definitely take it into consideration to make sure we make the best decision.

Thanks for reminding me that I also have to collect and file for sales tax if I were to do my business’ accounting tasks. I’m not sure if I were equipped to do that and none of my friends could probably help. Maybe I should give accounting school a try first before starting my own business.

It’s good to know that new business owners need to start saving for income taxes as soon as they start actually making money. Additionally, it’s a good idea to find a local accountant to work with to help the process of income taxes go smoothly and avoid common mistakes. This info should be helpful to anyone planning on starting a small business, so thanks for taking the time to share!

Thanks for pointing out that separating bank accounts will help a lot in sorting out the finances of a business. I’m thinking about hiring business legal services for when I start my own retail company someday. I can imagine that such services will also be able to help me understand everything I need to know about certain banking transactions in order to stay in line with the law.