If you asked which topics cause the most stress and conflict between married couples, you’d probably answer the toilet seat and finances. Both are worthy answers, but financial issues top the charts of most significant marriage stressors. Fourty-one percent of Gen Z couples argue about money at least once a month, according to Creditkarma.

One startup company is fighting to make that statistic a thing of the past: One Goal Finance. It helps couples get in sync by transforming fiscal mindsets from a “yours and mine” mentality into a united “ours.” The app’s tools are designed to teach couples to spend, save, and dream in unison, united by common goals, even if your marriage includes the polarized personalities of one spender and one saver.

Cory McArthur, the app’s creator, believes there is a better way for couples to communicate about money. He and his wife, Katie, set out to change the assumption that financial arguments were forever destined to haunt marriages. McArthur started One Goal Finance in 2019 as a side project, then joined the University of Utah’s Master of Business Creation (MBC) program at the David Eccles School of Business, hoping to turn One Goal into a scalable company.

“I was drawn to the MBC program because it’s similar to a startup incubator, with mentorship, coaching, and applied coursework that will help my business,” McArthur said.

The MBC program is unique among graduate business programs and startup accelerators. It provides mentorship, applied curriculum, scholarships, and education designed to meet the needs of startup companies – exactly what McArthur was looking for.

“I didn’t know what I didn’t know,” he said. “I have been trying to create a scalable business on my own, and I have recognized that there is a lot I can learn from others who have been there and done that.” McArthur has gained support from teachers with past entrepreneurship experience. He said, “Being able to learn from other founders, apply those learnings to my business, and connect with other like-minded founders has been so encouraging.”

One Goal founder Cory McArthur and his family.

In the early days, McArthur’s app attracted several early fans willing to pay before joining the platform. Since starting the MBC program, he has signed two new channel partners and has been exploring new ways to attract more customers. He’s excited about the potential for growth.

One Goal Finance’s unique focus on couple cooperation and the joy of accomplishing common goals carries the hope that money talk doesn’t have to take place on a battleground. Planning and dreaming together can become a source of bringing couples closer.

Plenty of apps and programs focus on saving money, but One Goal aims to do more – to help couples learn that financial compatibility doesn’t mean being identical; it means being complementary.

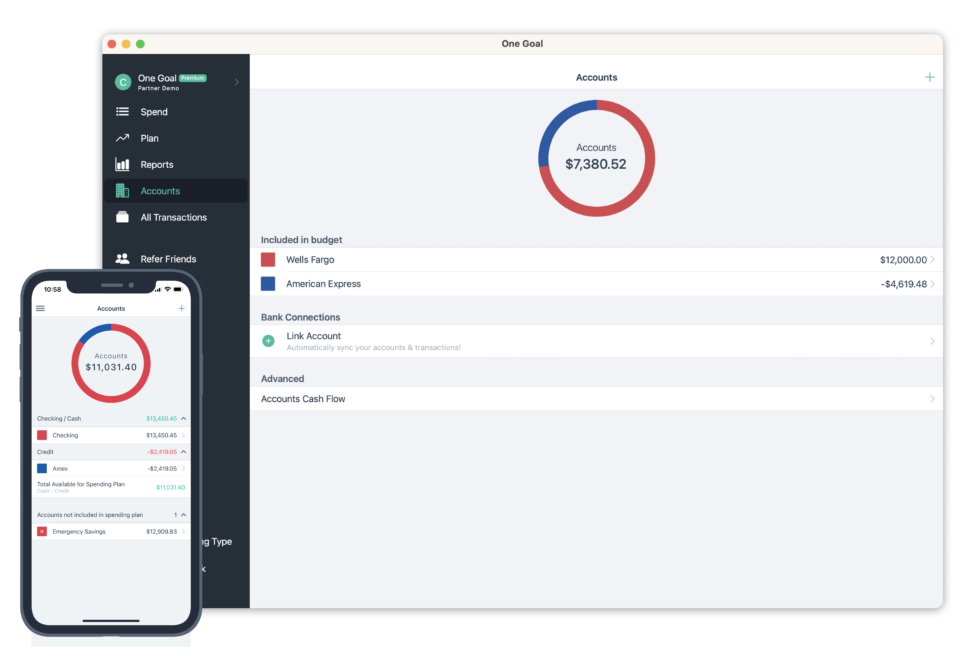

Couples choose “one goal” they’d like to achieve together, such as getting out of debt, saving for a vacation, or putting a down payment on a house. Then, using the app, they create spending plans and savings goals, and dream together about the future. The tools help couples track their progress, stay motivated, and celebrate each financial win.

Engaging user experiences keep money management light-hearted. For example, the app shows expense categories divided into colorful sections. If a couple overspends in one category, that section of the screen “explodes” into pixelated pieces, a comical way to notify users of the overdraw. But don’t worry; the app guides users through steps to get back on track. And when that expense category is back in the clear, the app celebrates those efforts with a shower of screen confetti.

The platform limits financial stress by shifting the focus away from Scrooge-like penny-pinching to identifying which funds are available to spend. The app also breaks down expenses into manageable categories. Cooperative financial management brings partners together with a shared vision that sets them up for success.

Numbers have always come easily to McArthur, and personal finance has become a passion. With a background in user experience design, he has enjoyed the challenge of merging his interests to create an app that takes the drudgery out of money planning. “I tend to stress over the finances,” McArthur said. “But after using my own One Goal system, I found myself suggesting to my wife that we go out to eat as a family. Hey, we’ve got money set aside for family fun. Let’s go spend it!”

The Master of Business Creation program has helped McArthur be strategic in how he markets One Goal. He has been able to design a marketing plan and create messaging and brand guidelines that match his vision.

Eventually, the McArthur hopes One Goal Finance will expand internationally and be translated into different languages and currency forms. The platform has already expanded to Canada and is available in English and Spanish.

But for now, as McArthur continues to work on his personal “one goal” for his business, he and his family are happy knowing One Goal Finance is out there, ready to help every household learn the skills to uncomplicate their financial lives and become empowered on their financial journeys together.

Learn more about One Goal Finance at onegoalfinance.com.

One Goal helps couples manage their budget together.